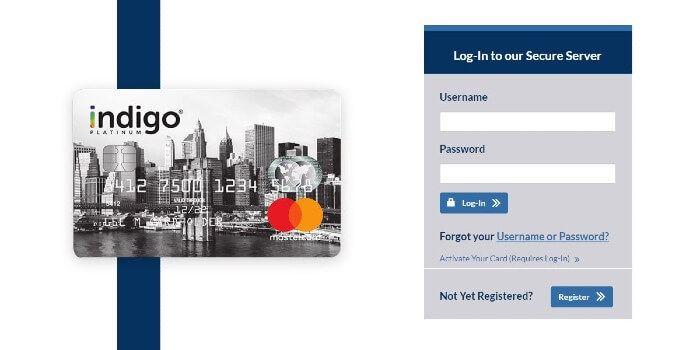

The indigo Credit Card offers features designed specifically for individuals looking to build or re-establish their credit. Finally, only apply for new lines of credit when necessary. Second, keep balances low on any existing lines of credit. First, make sure to pay all bills on time every month.

To improve your chances of building strong credit, there are several steps you can take. Building your credit takes time and effort but is worth it in the long run. You may be able to rent an apartment without needing a co-signer, obtain better insurance rates, and even secure employment in some cases. Having a good credit score opens up many opportunities that are not available to those with poor credit. It's essential to maintain good credit because it can affect your ability to get approved for loans or mortgages and impact the interest rates you'll receive. A credit score is a numerical representation of an individual's creditworthiness, based on factors such as payment history, amount owed, length of credit history, types of credit used, and new credit inquiries. Understanding credit scores is crucial for anyone looking to build their credit and achieve financial stability. In turn, having an excellent credit rating offers many benefits when seeking loans or other forms of financing later on - making it essential to strive for a good score throughout life's journeys! Understanding what impacts such figures sets you on the right path towards bettering them over time.

While there are numerous ways to improve upon low scores, doing so takes time and patience. Ultimately, improving your credit score means being responsible with money management while establishing sound long-term habits that positively reflect your financial health. Thirdly, avoid opening multiple new accounts simultaneously since it lowers the average age of your accounts and also signals potential financial instability. A high ratio of debt-to-credit limit can negatively impact your score. Secondly, reduce outstanding debt by paying down balances as much as possible. First, ensure timely payments on all debts late or missed payments will significantly damage your score. Improving your credit score requires taking steps to address these variables systematically. Several variables affect this score, including payment history (35%), amounts owed (30%), length of credit history (15%), new credit accounts (10%), and types of credit in use (10%). The most commonly used credit score model is FICO, which ranges from 300 to 850. But you're seeing this because you're like me and for rebuilding credit its fine I just eat the annual fee and suck it up I'll close it at the 2-3 year mark when my other credit limits are higher.Credit scores play a crucial role in determining one's creditworthiness, and understanding the factors that impact them is vital for managing personal finances. Is indigo a great credit card for everyday usage? Nope. I've since gotten mission lanes card with a $500 unsecured limit and they give an increase to $1000 at 6 months with annual fee of $59 so I suggest going secured cards-indigo-mission lane, always be on time and don't even use them if you don't have to people will tell you that you have to use 20% but that's a myth you don't HAVE to use it just don't go OVER 20%. They have no app which I don't like but payments can be made online and I've had no problem doing it. Indigo was the first unsecured card I could get with a 300 limit and 75 annual I believe but they are upfront and there were no hidden costs. In a little over a year I went from 415 to 600 by being aggressive with my credit disputes, using self lender and getting as many cards as I could but could only get secured cards. Went through foreclosure and some bad credit decisions young.

0 kommentar(er)

0 kommentar(er)